16 Mar Where there is a will there is a way!

“The Federal Government is starting to plan for climate change by making extended forecasts that can help people. Plan for extreme weather – because what can go wrong when you combine the efficiency of Government with the accuracy of weathermen?”

Jimmy Fallon

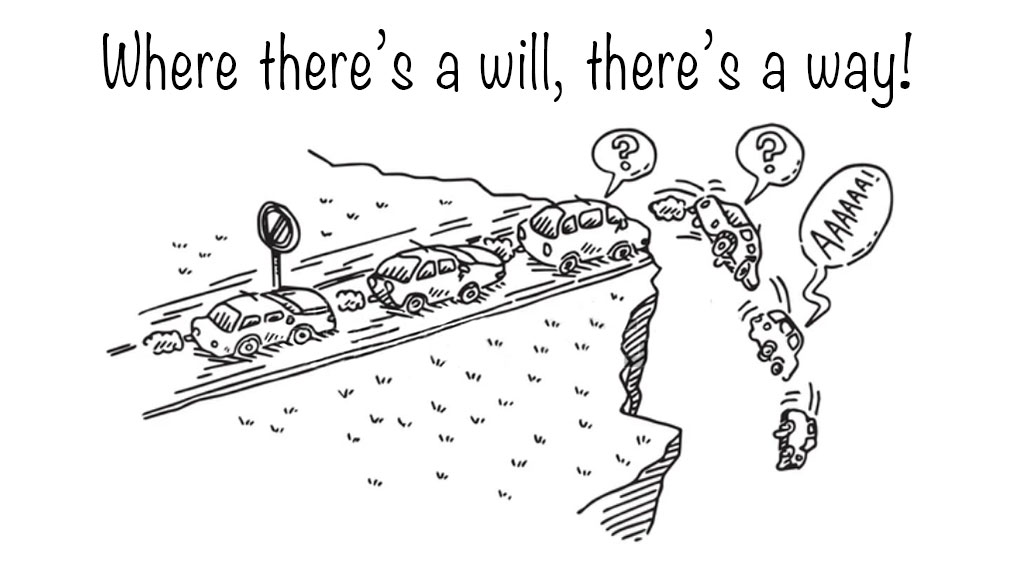

At this time last year, we commented on a new variant of Covid appearing to throw the Country another curve ball, and that its influence on NZ society would wane. That has proved true, not that the virus has disappeared, but more from NZ and the World learning to live with it, and the effects of extreme climate events, particularly for the mid to upper North Island now taking the limelight. Our thoughts go out to all the people and business’ in the mid to upper North Island that have suffered from this summers weather events. The frailties of this Country’s roading, power, and communications infrastructure have been laid bare, by Cyclone Gabriel. Whilst other 1st World Countries build and maintain expansive highways, autobahns and tunnel networks we have tended to follow the geography of the land, which in a lot of cases creates a winding roading and rail network around the side of cliffs or through gully’s, and a lack of ongoing maintenance and upgrading, is now being exposed. New Zealand is a long narrow Country, which experiences extremes of weather at various times of the year, and though we may not experience a larger number of these events, we will experience more severe one’s. Highway 25A, the Kopu Hikuai Road, in the Coromandel is an example of this. It would be closed or have limited access 10 times a year, due to slips or subsidence, and this has been ongoing for many years, with a band-aid applied to cure the latest issue, without rectifying the issues of this arterial route, and there are many similar highways in the Country.

Cyclone Gabriel, and for Auckland the unexpected downpours of the previous week, which were just as bad for the city, has brought into the spotlight a large number of issues, and not just fragile infrastructure. The intensification of housing, without improving services – particularly wastewater/stormwater, the lack of maintenance of roads, drainage and trees, and the development of housing in flood prone areas or sites prone to slips. I would suggest that a lot of the houses that were severely flooded were developed in an area that is classified as being prone to flooding. It will be interesting to see how far some of the homeowners get with seeking Government and or Council compensation for the damage done to their properties, where it is tagged as being flood prone.

The cost of these storms will have a short-term inflationary effect on an already stretched Civil and Construction industry and provide an initial negative impact on the Countries economy, however, like the Christchurch earthquakes, will provide a medium to longer term benefit, as repairs and rebuilds occur. As the worst hit areas comprised some of the Countries best horticultural regions, you would expect the price of some primary produce to increase, just as it did at the end of 2022 after the market garden growing regions South of Auckland suffered from a period of very wet growing weather. There is likely to be a long-term effect on the supply of fruit and grapes for wine, as the “Fruit Bowl” of NZ is now under meters of silt, which in a lot of cases will take years to recover. The majority of the cost will need to be covered by the Government, whether that be an increase in or new tax (unlikely as it is an election year), a reduction in spending somewhere else (unlikely given this Governments past performance,) or borrowing. There will be a large portion of capital injected into the economy from insurance companies, which largely comprises capital from offshore underwriters, providing a boost to local economies. This is set against the Reserve Bank trying to dampen the economy, and control inflation. We can only hope the lag between now and the flow through effects of this occurring that inflation is closer to the Banks target, or at least shows signs of getting there. The latest 0.5% increase to the OCR came with a statement from Adrian Orr aimed at both the business community and the Government, to stop fuelling the inflationary fire. The Government must take most of the blame here as they seem to increase the minimum wage every few months. The Banks have generally priced this lift into lending rates, certainly their fixed term rates, so we would only really expect a lift in floating rates.

The finance industry has started the year in a cautious mood, funders are very selective as to what they will jump into, with land bank and development funding particularly hard to source. Historically development funders have been prepared to finance developments with few or no pre-sales if the residual position is lowly geared, however they currently require a strong level of pre-sales to demonstrate demand and pricing of the end product and are much more conservative on end exposure levels.

The offshore based funds that we deal with have also pulled their gearing back, with Australian lenders commenting that they consider this Countries economy and property markets are more depressed than Australia’s. We do however have cashed up local funders and offshore funders looking for opportunities, so please contact us should you want to discuss something. We have successfully sourced capital for business finance, rural and forestry finance, short term-bridging finance and property finance, including residential, commercial and industrial:

- Development finance

- Investment and Going Concern finance

- Land acquisition, sub-division development finance

- Bridging

- Refinance and restructuring of existing facilities

We will work directly with our borrowers, or with finance brokers and lenders to obtain the best possible solution agreeable to all parties.

We look forward to hearing from you.